Making an international payment?

Pay someone abroad in 2-3 working days.

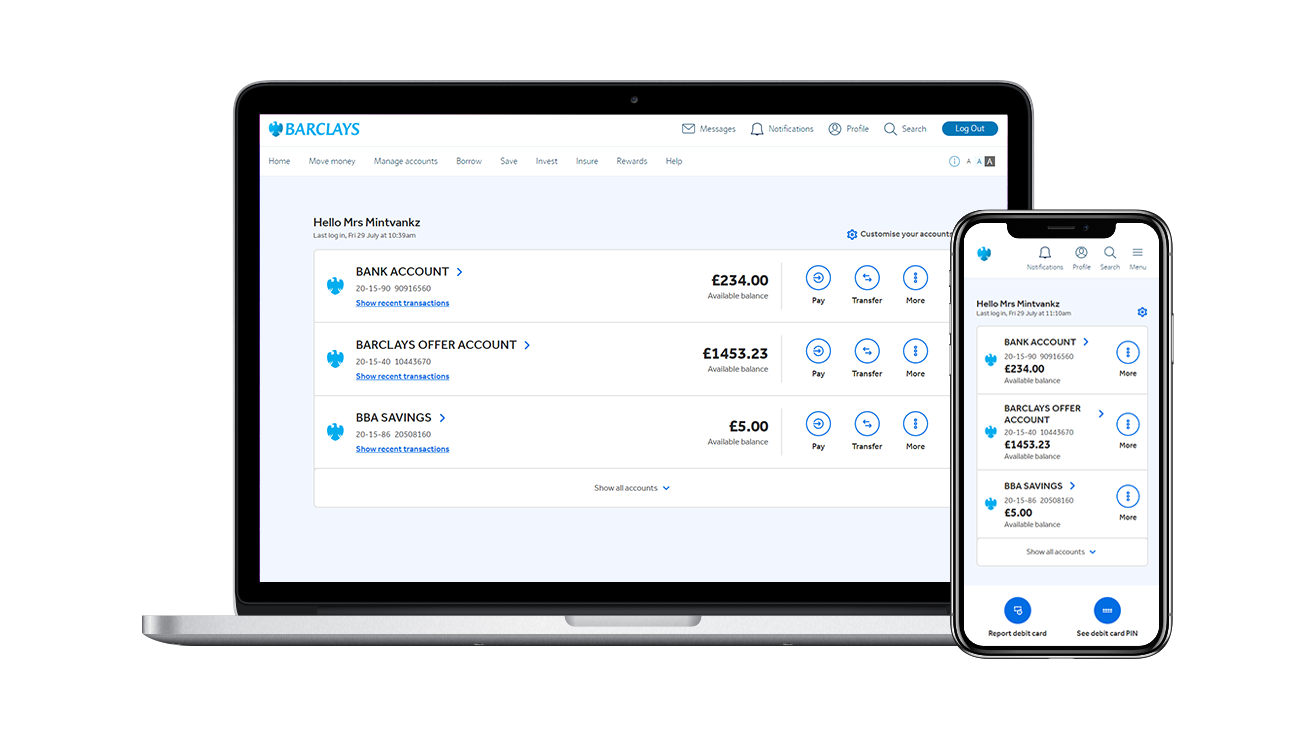

Bank from your browser

Prefer to do your banking on a bigger screen? We’ve been improving Online Banking to make it even easier to use.

See how you can manage your money safely and securely using Online Banking and the Barclays app – from checking your balance and transferring money, to managing standing orders and Direct Debits.

We’ve been busy brightening up our homepage, so you’ll soon see it looks a bit different. Most things are still in the same place – it’s just the look and feel that’s new.

There’s also a new page where you can reorder and rename your accounts, and choose whether to show or hide them on your homepage.

You might be surprised at some of the things you can do in Online Banking.

Pay someone abroad in 2-3 working days.

You can securely access your 4-digit PIN number online.

Order your annual tax or interest statements online.

Go paperless to view, download and print your documents whenever you need them – it’s secure and convenient.

You can change your address online instantly.

Stop and re-order a lost or stolen card 24/7.

There are lots of reasons why your card might not be working online, at a cash machine or in store. Our handy tool can help you work out what the problem is, and how to fix it.

Stay safe online

Discover ways to help keep control over your personal data online.

Protect your accounts

PINsentry gives you added protection for your accounts – as well as access to our full Online Banking service.

Awarded for Online Banking, the Barclays app, and the Barclaycard app by the British Standards Institution (BSI)

An internationally recognised standard for information security management systems, used to manage sensitive data.

A government-backed, industry-supported scheme, set up to help organisations protect themselves against common online threats. The scheme has two levels of certification, Cyber Essentials and Cyber Essentials Plus, and we’ve achieved both.

Banking to suit your needs

If you’re checking your balance, sending money abroad or collecting travel money, we’ll help you find the easiest way to do it.