Which accounts?

Pay into any Barclays sterling current or savings accounts (excluding ISA and Bond accounts, or accounts from other banks)

All you need is a smartphone or device

We’re always looking for new ways to make your life easier and to help you save money. Getting to a branch in opening hours isn’t always possible, so now you can pay in cheques – anytime, anywhere – in a convenient way.

Pay in cheques by using the Barclays app and your smartphone’s camera1. Just take a photo of the cheque and submit it through your app, with the amount and payee details.

You’ll get the money in your account by 23:59 the next weekday2, if you pay the cheque in by 15:59 the weekday before, so there’s no more waiting around for your money to clear.

Pay into any Barclays sterling current or savings accounts (excluding ISA and Bond accounts, or accounts from other banks)

Pay in sterling cheques of up to £2,000 each – four cheques every seven days if you’re a personal or Premier customer, and 20 if you’re a business customer.

It’s just as secure as paying in a cheque at a branch

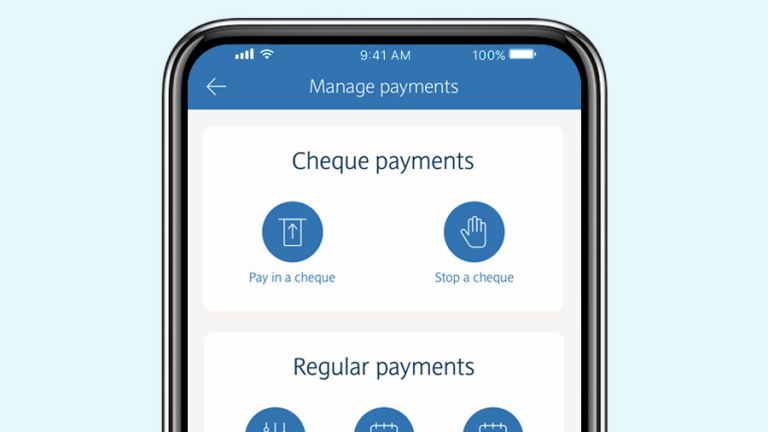

Log in to the Barclays app and select ‘Pay & Transfer’ at the bottom of the screen, then tap ‘Pay in a cheque’.

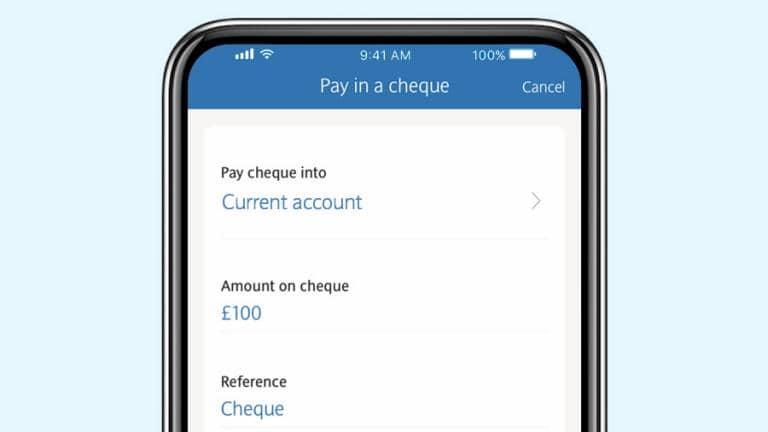

Choose the account you want to pay your cheque into. Enter the amount and a reference if you need one, then select ‘Take photo’.

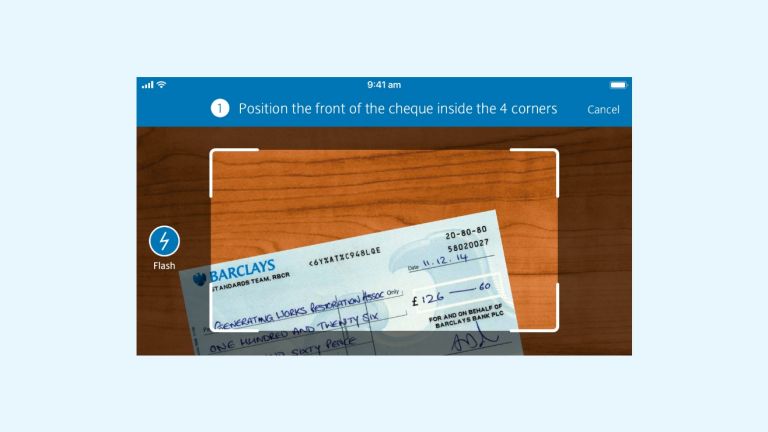

Your phone’s camera will automatically switch on. Place the cheque on a plain background that’s darker than the cheque. Make sure the whole cheque is visible within the corners of the frame. Hold your device steady and the app will automatically take a photo of the cheque. The corners of the frame will change to green when the picture has been taken.

Tap ‘Pay in cheque’. That’s it – all done.

Once you've logged in, select ‘Pay and Transfer’, then ‘Pay in a cheque’.

Next, choose the account you want to pay the cheque into.

Enter the amount shown on the cheque – you can pay in any cheque up to £2,000 in the app – and add a reference.

If it's the first time you're paying in a cheque, you'll need to read through the terms and conditions.

If you're happy, select ‘Accept’ and then ‘Take photo’.

Place your cheque on a flat, dark surface so it stands out from the background.

Turn your smartphone horizontally and hold it over the cheque so all four corners are visible and inside the gridlines.

If the app takes a long time to take a photo, it’ll show helpful tips to take a clear, good quality image.

Follow the tips and try again.

When the cheque is correctly lined up, the screen will turn green and the app will automatically scan the cheque.

If the photo is blurred or crooked, select ‘Try again’.

If the photo looks OK and is within the gridlines, select ‘Use image’.

You'll then need to take a photo of the back of the cheque.

Once you've done this and selected ‘Use image’, you'll be able to review it.

If all the information is correct and you’re happy that all the images are clear, select ‘Pay in cheque’.

You'll then see a confirmation screen that your cheque has been paid in.

If the cheque hasn't been submitted, you'll see an error message.

Select ‘Done’ to finish.

And, if the cheque is paid in by 3:59pm Monday to Friday, excluding UK bank holidays, the money will be available by 11:59pm the next working day.

Remember to write ‘Paid in’ and the date you’ve paid it in, on the back of the cheque.

You can pay in up to four cheques every seven days – 20 if you’re a business customer – starting from the day you pay the first cheque in.

If you reach your limit of paying in cheques through the app, please visit a branch if you need to pay in any more. You can also pay in cheques at a Post Office, though cheques paid in this way will take longer to clear, or you can wait until your seven-day period refreshes in your app.

You can keep track of the cheques you've paid in by selecting ‘View cheques paid in’ and the account you paid them into. Then, just pick the cheque you want to track.

If you have any questions, visit our FAQ page.

Yes. You can pay in most cheques from UK banks, but some issuing banks don’t allow photo cheque clearing. If you try and pay in a cheque from one of those banks, you’ll get a message telling you to take the cheque to a branch to pay it in.

You can use your app to pay in a set number of cheques every seven days, depending on the type of account you have

We may change these limits at any time. If you need to pay in more cheques than the limit, please visit a branch.

The day you pay in a cheque in the app for the first time. It resets every seven days after that.

You can use your app to pay in up to £2000 per cheque

We may change these limits at any time. There’s no limit to how many cheques you can pay in at a branch.

The cheque might still have been paid in. You can check by selecting ‘View cheques paid in’. If you can see your cheque there, it worked.

If it didn’t work, try paying it in again when you’re in an area with better reception.

And don’t worry, you can’t pay in the same cheque twice – we’ll warn you if you try to do that.

It might be that your photo didn’t capture all the details we need. Please take another photo of your cheque. Make sure that

Some smartphone cases interfere with the camera, so removing the phone from the case can make photographing your cheque easier.

If you've tried this and the problem continues, please pay in your cheque at a branch.

Yes.

If we can’t process your cheque through your app, we’ll let you know what to do. You can also contact us to talk about paying in a cheque using the ‘Call us' button in your app.

If you can’t see the option to pay in a cheque with your app as usual, it might be because we’re making improvements to this service. You can use our service status page to see if it’s available.

You should write 'paid in' on the back of the cheque and keep it for at least 10 days in case we need to contact you about it.

There are different limits for the number of cheques you can pay in using your app based on the type of account you have with us.

If you have personal and business accounts, you can choose which account to pay a cheque in to, up to that account’s limit.

If you only have a business bank account, or if you’re logging in with your business banking details, and your limit is four cheques, please call us on 0345 600 23233.

You can still pay in cheques at a branch as normal. We’ve recently upgraded all of our branches, which means your cheque will now clear by 23:59 the next weekday – as long as you’ve paid in the cheque by the branch’s cut-off time on the weekday before.

This means that all cheques now clear faster – so don’t get caught out when you write one. Make sure you always have enough money in your account to cover them. Learn more about the cheque clearing cycle and the future of cheques.

The Barclays app4 is here to help you manage your money on the go – safely and securely. But there’s much more to it than that.