Explore all Barclays has to offer

See how we can help you with current accounts, mortgages, insurance, loans, credit cards and savings accounts.

Personal Banking

Find your way to new adventures

Whether you're staying on top of your everyday spend, saving for tomorrow, or starting to plan for the future, we're here to help make money work for you.

We’re here to help if you have a residential mortgage with us

We’re supporting the new Mortgage Charter announced by the Government on Friday 23 June 2023.

Take a look at our mortgage support hub to see what help we have available.

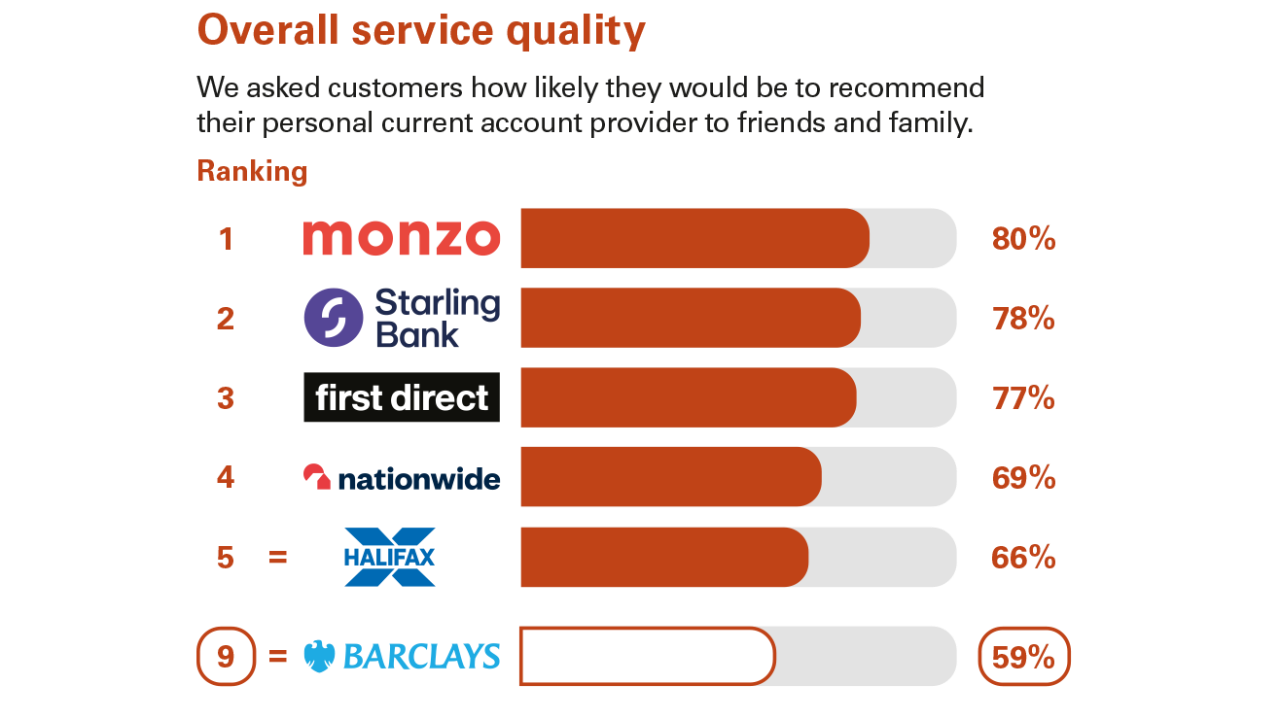

Independent service quality survey results

Personal current accounts

An independent survey asked customers if they would recommend their personal current account provider to friends and family.

The Financial Conduct Authority also requires us to publish information about service. The requirement to publish the Financial Conduct Authority Service Quality Information for personal current accounts can be found here

Authorised push payment (APP) fraud rankings in 2022

Authorised push payment (APP) fraud happens when someone is tricked into transferring money to a fraudster’s bank account.

These charts use data given to the Payment Systems Regulator (PSR) by major banking groups in the UK in 2022.

You can read the full report by visiting www.psr.org.uk/app-fraud-data

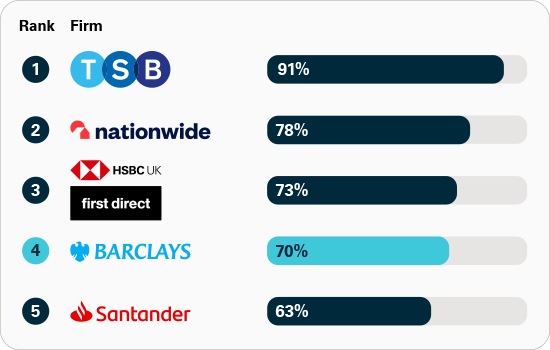

Share of APP fraud refunded

This data shows the proportion of total APP fraud losses that were reimbursed, out of 14 firms. Higher figure is better.

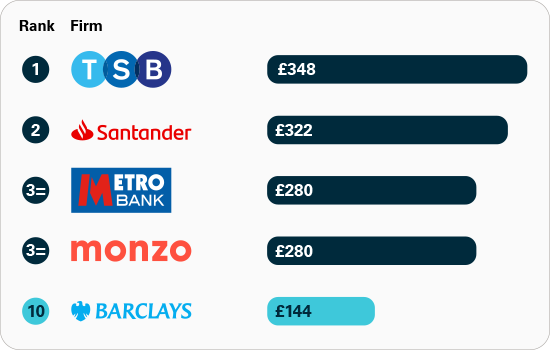

APP fraud sent per £million transactions

This data shows the amount of APP fraud sent per million pounds of transactions, out of 14 firms. Lower figure is better.

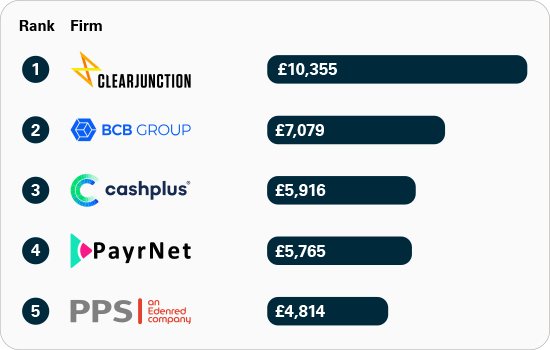

APP fraud received per £million transactions: smaller UK banks and payment firms

This data shows the amount of APP fraud received per million pounds of transactions, ranked out of 20 firms. Lower figure is better.

APP fraud received per £million transactions: major UK banks and building societies

This data shows the amount of APP fraud received per million pounds of transactions, ranked out of 20 firms. Lower figure is better.

Important information

* You must be 16 or over and have a Barclays current account, mortgage account or a Barclaycard to use the Barclays app. If you're 11 to 15, you can use another version of the app. Terms and conditions apply.