Supporting your business, every step of the way

We’re here to help your business thrive. We’ve got the business funding and expert support that can help drive your business forward.

24/7 business support

Send us a message from the Help section of your app(1) 24 hours a day, 7 days a week. Switch notifications on so you know when we’ve replied.

900,000 businesses bank with us

Join a community of over 900,000 businesses benefitting from expert support, partnerships and finance services.

Over 300 years of expertise

Benefit from our experience and knowledge, and services that cover most industry sectors.

24-hour fraud protection

Keep your finances safe – we look out for you and your money around the clock.

Up to £85,000 FSCS protected

Get guaranteed protection of up to a total of £85,000 by the FSCS if your bank goes out of business.

Hassle-free switch guarantee

Switch to us and we guarantee to move all your incoming and outgoing payments on your switch date for free.

More reasons to choose us

We thrive on relationships with our customers, and we’re committed to building trust. That’s why we’re dedicated to offering you more than just banking.

Get support and guidance from experts with Eagle Labs

As a member, you’ll get free access to our dedicated growth programmes, virtual and in person one-to-one mentoring, masterclasses with industry experts, live events and more. Connect with our ecosystem of startups and established businesses to accelerate your ideas.

Enjoy the added benefits of Barclaycard Payments

With expertise in making and taking payments, Barclaycard Payments can help you reach new customers, streamline processes, unlock cashflow and more, whatever your business size, sector, or ambition. Subject to application, financial circumstances and borrowing history. T&Cs Apply.

Making our services available in your community

Do most of your day-to-day business banking without going into a branch – from getting cash collected from your business to depositing cash at the Post Office.

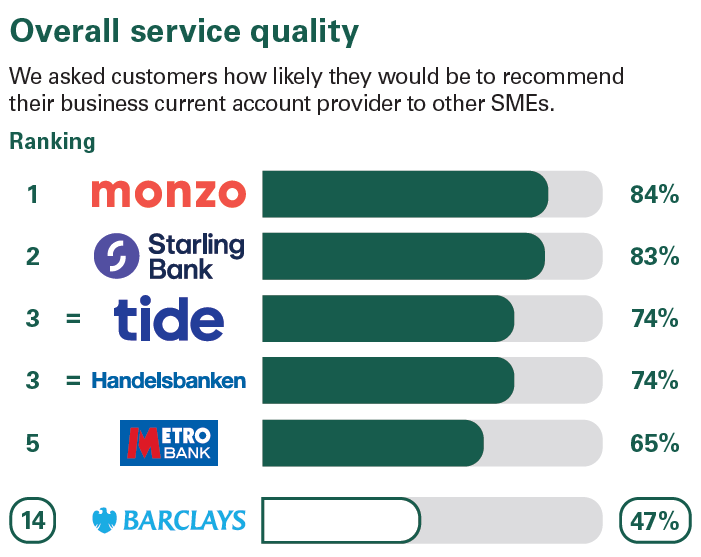

Results from an independent service quality survey

As part of a regulatory requirement, an independent survey asked customers what they thought of their bank, including ours. The results represent the views of customers who took part in the survey.

The Financial Conduct Authority also requires us to publish information about service. The requirement to publish the Financial Conduct Authority Service Quality Information for business current accounts can be found here.

The Financial Conduct Authority also requires us to publish information about our service.

See the information we’re required to publish by the Financial Conduct Authority Service Quality Information about our business current accounts.

Important information

You need to be 18 over to access this product or service using the app. T&Cs apply.(Return to reference)

When you open a business account using Online Banking, you’ll get free access to the FreshBooks package developed exclusively for our business customers. FreshBooks is offering this free for anyone who has a business current account with us. Barclays Bank PLC only gets commission from upgrades.

The package is based on the existing FreshBooks £22 a month package, with some additional features. FreshBooks usually charges for its packages. You’ll only get the FreshBooks service free if you complete the sign-up journey with FreshBooks through our Online Banking referral and agree to the FreshBooks terms and conditions. The service will be free for as long as you continue to be an eligible Barclays business customer. If you close all your business current accounts, your free use of the FreshBooks service will end. If we end our partnership with FreshBooks, you won’t get the FreshBooks service free anymore. We’ll let you know if that happens. You’ll then need to download all your data and reports to make sure you keep your records safe and secure, so that you comply with Making Tax Digital requirements. Find out more at gov.uk/government/publications/making-tax-digital/overview-of-making-tax-digitalWe don’t offer tax advice. If you’re not sure about tax, or how VAT and other forms of tax work, seek independent financial advice. You can find more information about tax on gov.uk.

You can choose to upgrade to a paid FreshBooks package at your own cost. If you decide to upgrade from the free FreshBooks service to another FreshBooks plan, and pay the full price to FreshBooks, Barclays Bank PLC may receive commission for this from FreshBooks. Referred products are owned and provided by FreshBooks. Alternative service providers in the market may offer similar products. If you sign up to FreshBooks, you’ll need to read and accept their terms and conditions, if you agree with them. Once you become a FreshBooks customer, you’re bound by their terms and conditions. (Return to reference)Subject to terms, conditions and eligibility.

(Return to reference)