Start a conversation with your kids about cash (and know what to cover too)

Timely chats about spending and saving at a young age can help to nurture a healthy relationship with money for the future.

It can be tricky to talk to children about money. It’s not often easy to know what to say, and when, in the hope they’re ready and willing to listen. But talking about spending and saving at even a very young age can help to spark a strong relationship with money for the future. And once you start the conversation, you might be surprised at how much your children know already.

We spoke to psychologists, financial education experts and families to find out what children of different ages might be thinking about money, from pocket money to part-time work. With expert talking points, age-appropriate tips and suggestions from parents, here’s our guide to helping your youngsters learn about money.

Is your child aged five or six? Show how you pay for goods with money

I like to count my money, but I don’t like to spend it all as then I won’t have any left!

Starting a conversation about money in these early years might feel a little too soon, but research shows that kids at this age are well-aware of how money plays a role in day-to-day life.1

Child psychologist Dr Elizabeth Kilbey suggests that parents can begin to introduce their children to the value of money at this age, showing them how you can pay for items using a certain amount, for example.

Talking point

We pay for a lot of things digitally and using cards. So, when you’re in the supermarket, show your kids the display on the card machine when you pay. You could even get them to guess what it’s all going to add up to, and make it into a game. I also recommend that parents spend a bit of time using cash, so kids can see how it works.

Leading child psychologist

The parent’s perspective

Kim, mum to five-year-old Jaxon, encourages her son to think about whether he really wants something before buying it, and only gives him pocket money when he keeps his room tidy.

“I’m no expert, but I try to teach him that he can only buy things that he has the money for,” she says.

Reference2

Is your child aged seven to 10? Explore the difference between ‘need’ and ‘want’

I know that money goes into my bank account, and that it’s being saved for my future

According to financial education charity RedSTART, this is an age where you can start teaching kids about three key money concepts: earning, saving and growing.

Sue Halewood, CEO at RedSTART, recommends giving your child a structured or regular way to earn money – such as through chores – and explaining the difference between ‘need’ and ‘want’ when it comes to spending.

Talking point

No matter how trivial it seems, get your child used to making small choices with their own money, from food items to small toys, so they can understand that these decisions will impact how much money they have left over for other things that they might want in the future.

CEO, financial education charity RedSTART

The parent’s perspective

Graham’s daughter Isla, 10, is already careful with money thanks to important lessons learnt early on. Graham remembers a time when Isla wanted to buy an overpriced toy that he knew she wouldn’t want later.

“We let her buy the toy, and sure enough she regretted it, but it made her realise that you need to be thoughtful about buying things!” he says.

Reference3

Is your child aged 11 to 13? Encourage them to regularly check their bank balance

Money is important because it gives us a house to live in and food to eat. And it means I can buy Bubble tea!

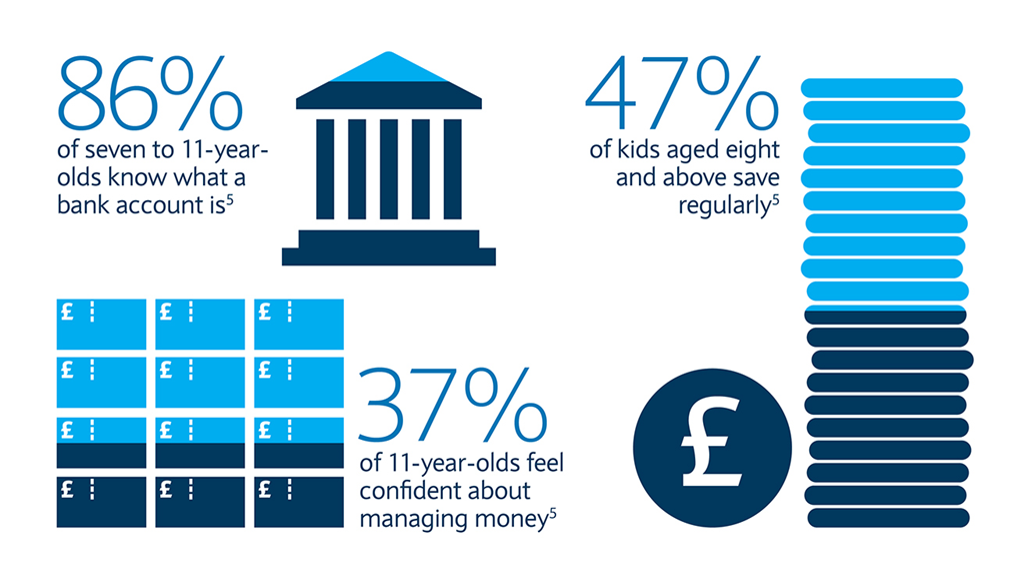

Pre-teens are digitally-savvy, with a Childwise report finding that 90% of children have their own smartphone by age 11.4

As society becomes increasingly cashless, it’s vital that children develop habits that can help them manage their money and remember its value, says Fiona Montgomery, Head of Education (School Age) at financial education charity MyBnk. This is particularly worthwhile at this age, when many youngsters will open their first bank account.

Talking point

Get them into the habit of tracking cash and checking their balance by using a banking app on their smartphone, and teach them the difference between available balance and actual balance.

Head of Education – School Age, MyBnk

Discover more tips to teach your kids about how to look after their finances in our money management guide5.

The parent’s perspective

Online shopping channels are unlocking a new level of financial awareness in Eloise, 12. Her parents help her to sell her second-hand items on eBay, which dad Nathan says is teaching her the satisfaction that comes with making your own money.

“Eloise is still a bit young for a part-time job, but this shows her there are other ways she can make a bit more than she gets from us,” Nathan explains.

Give your children greater control over their finances with the BarclayPlus bank account and Barclays app6, available to children aged 11 and over. As well as checking their balance, they can set limits on their card, move money between accounts and even personalise7 their card with an image of their choice.

Reference8

Is your teenager aged 14 to 17? Help them take responsibility for their own money

Money comes from working hard, and being smart and investing it

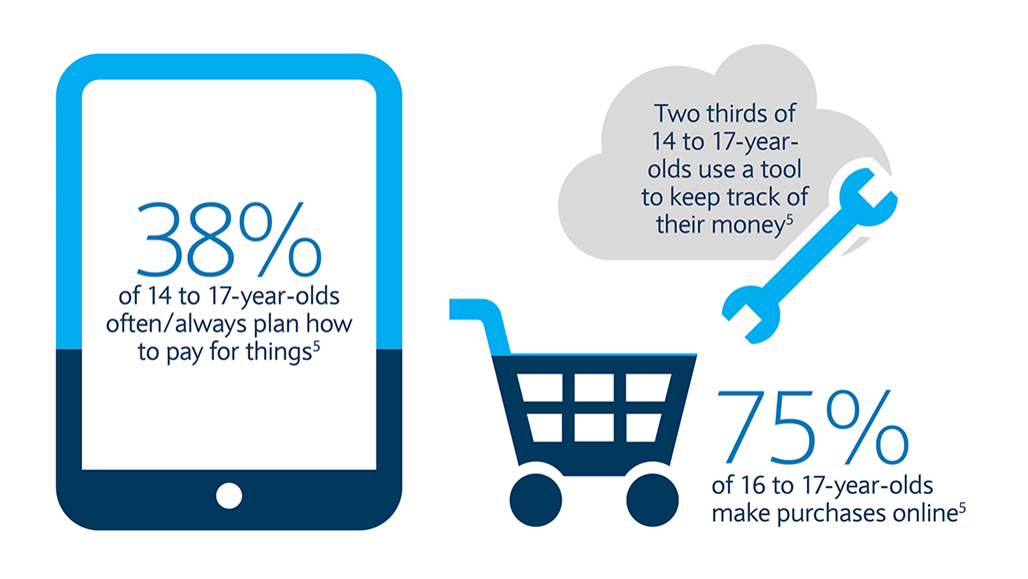

This is a pivotal age for your child and their relationship with money, as now they have much greater opportunity to earn it for themselves. Some 201,000 16-17 year olds in the UK were in paid work in July 2021, according to Government research9.

Sian Bentley, Moneywise Teacher of the Year winner in 2019, says it’s important to teach teenagers to take responsibility of their own money, taking examples from your own family finances. While you may not want – or need – to go into too much detail about precise figures, it can be really valuable in showing them how your monthly outgoings work.

According to Kirstie Mackey, Head of Barclays LifeSkills, educating young people about their finances can enable them to make more informed decisions about money – and their future in general.

“It’s important to start early in supporting the development and learning of money management and budgeting,” she says. “This will help set young people up with good money habits for the future.”

Talking point

It’s fundamental in today’s world to discuss topics such as online banking and digital currency with young people. This seems to be particularly relevant to them as money trends have been moving away from cash towards a ‘tap and pay’ culture. Exploring opportunities that banking apps can provide like tracking income, outgoings and savings has supported my students to see the importance of money management. Savings is a big topic for us and some of the statistics, for example about how much things cost and what they could afford, shock students and make them think.

Head of Year 9 and SEN Teacher, Preston Manor School

The parent’s perspective

Mark says his 17-year-old daughter Anna is a dab hand at saving and managing money. Her sensible approach came from having a piggy bank when she was younger and helped her to understand the value of money, he adds.

Mark also thinks it’s important to get teenagers working. “Encourage them to earn money as early as possible,” he says. “That doesn’t mean just washing your car – get them out into the world!”

For 16 and 17-year-olds, a Barclays Young Person’s account is great for managing money. As well as being free10, safe and packed with features, your child can get easy access to their finances in branch, at ATMs and through our app6.

Reference11

At certain times throughout this article you may be linked to websites owned and operated by other organisations and will be subject to their terms and conditions.