You own the property

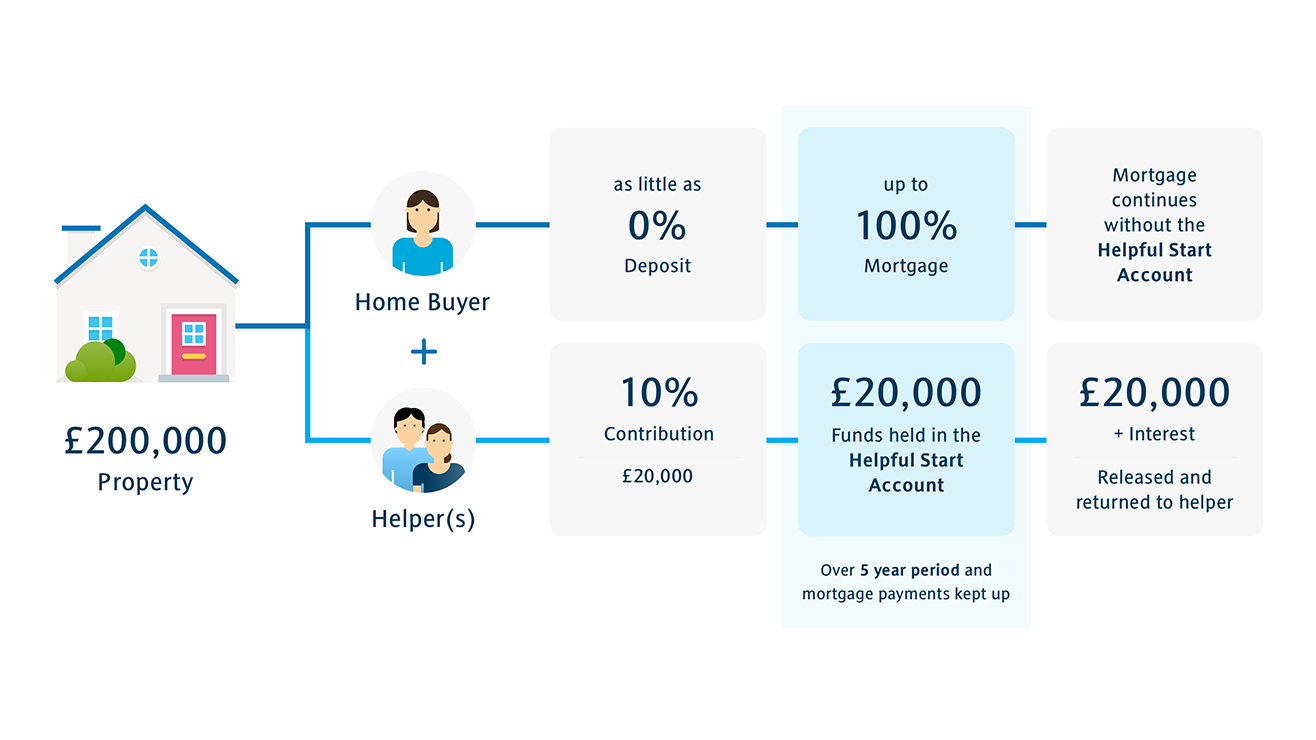

Use your family or friend’s savings to buy your own house with your own mortgage – and they’ll get their money back, with interest.

Buy your home with help from a loved one

Saving for your first home isn’t easy – now family and friends can help with the deposit.

Your home may be repossessed if you do not keep up repayments on your mortgage.

Use your family or friend’s savings to buy your own house with your own mortgage – and they’ll get their money back, with interest.

You can borrow the full purchase price of your home because your helper provides 10% as security for five years1.

Paying over a longer term could help make mortgage repayments more affordable for you.

Select a fixed rate for five years, so you’ll have the security of knowing your mortgage payments won’t change over that time.

Family, friends, loved ones and anyone who’d like to help someone they know to buy a home.

Open a Helpful Start account in your name and transfer 10% of the property purchase price into it as security on their mortgage.

You’ll earn an attractive rate of interest on your savings for the agreed term.

You can help more than one family member or friend get their own place, at the same time. And once you get your money back, you could use it again to help others.

Call us or visit a branch to make an appointment where we can discuss whether our Family Springboard Mortgage is suitable for you.

Whether you’re a borrower or a helper, get started by calling 0333 202 7580 to book an appointment.

Lines are open Monday to Friday from 7am to 8pm, and from 7am to 5pm at weekends. To maintain a quality service, we may monitor or record phone calls. Call charges.

Find a branch near you that offers appointments with mortgage advisers and see when we’re open.

You can also check our full mortgage range [PDF, 562KB] to see if our other mortgages are suitable for you, download our

tariff of mortgage charges [PDF, 265KB] and read our legal information.

Your helper will need to seek independent legal advice for the mortgage application. This can’t come from the same solicitor who is handling the purchase of the property, but it can be someone from the same company or business. You or your helper will need to pay their fees.

We ask you to get independent legal advice because we want you to fully understand the implications of putting your money into the Helpful Start account. This can’t come from the same solicitor who is handling the purchase of the property, but it can be someone from the same company or business. You or your loved one will need to pay their fees.

If the home buyer can no longer make their mortgage payments, we’ll keep your deposit in the Helpful Start Account for slightly longer than the agreed term.

If we need to repossess the property, you could lose some or all of the money in the Helpful Start account if there is a shortfall between what we’re owed and the amount we sell the property for.

Please see here for the Helpful Start account’s latest terms and conditions. [PDF, 249KB]

For those customers with an existing Family Springboard Mortgage prior to June 2019, you can find the Family Springboard Mortgage terms and conditions here. [PDF, 268KB]

Please note that the mortgaged property and borrower must be situated in the United Kingdom, which is England, Wales, Scotland and Northern Ireland. The Channel Islands and the Isle of Man are not part of the United Kingdom.

Find a branch near you that offers appointments with mortgage advisers and see when we’re open.

Whether you’re a borrower or a helper, get started by calling 0333 202 7580 to book an appointment.

Lines are open 8am to 8pm, every day. To maintain a quality service, we may monitor and record phone calls. Call charges.

Buy part of a home and pay rent on the rest

A government-backed scheme helps you buy a home with a fraction of the usual deposit or mortgage.

Buying property with other people

Buying property with your partner, family or friends can make sense, as long as you weigh up the benefits and risks of taking out a joint or guarantor mortgage.

…and make money work for you

Your money – the way you spend it, save it and (try to) look after it can be complicated.

Protect your family

Have you thought about what would happen to your loved ones if you died or became terminally ill? With Barclays Simple Life Insurance, you can give them some financial security with a one-time payment – from £6 a month.

Help protect your family and get a £75 e-voucher

If you die, or become terminally ill – meaning you’re expected to live less than 12 months Barclays Simple Life Insurance could give your loved ones some financial security. They’d get a cash lump sum to spend however they like – this could include paying for university or paying off debt.

If you get a quote for Barclays Simple Life Insurance between 8 January and 31 May 2024, and you go on to take out the policy before the quote expires, we’ll give you a £75 e-voucher to spend on a range of gifts including days out and vouchers for high-street brands.

Simply Thank You will email you between months five and six of your policy’s start date to tell you how to claim your reward. You’ll need to use your voucher by 31 May 2025.

Peace of mind for your home

Whether you’re a first-time buyer or only have a few years left on your mortgage, make sure your home is protected if you die or become terminally or critically ill.

Barclays Life Insurance is underwritten by Legal & General Assurance Society Limited. When you select ‘Get a quick quote’, we’ll take you to Legal & General’s website to complete your application securely. Terms, conditions, exclusions and eligibility criteria apply.

Help protect your family and get a £75 e-voucher

If you die, become terminally ill – meaning you’re expected to live less than 12 months – or you choose critical illness cover and are diagnosed with a specified critical illness, mortgage protection life insurance could give your loved ones some financial security. They’d get a cash lump sum to spend however they like – this could include paying towards your mortgage.

If you get a quote for mortgage protection life insurance between 8 January and 31 May 2024, and you go on to take out an insurance policy before the quote expires, we’ll give you a £75 e-voucher to spend on a range of gifts including days out and vouchers for high-street brands.

Simply Thank You will email you between months five and six of your policy’s start date to tell you how to claim your reward. You’ll need to use your voucher by 31 May 2025.

Terms conditions and exclusions apply.