Future of cheques

Faster clearing with image processing

Cheques have changed. All cheques are now processed as digital images, which means you can now pay in a cheque whenever it’s convenient and you’ll get your money much quicker.

Pay in a cheque using your Barclays app or at one of our branches – the money is typically available by 23:59 the next weekday if you pay in the cheque before the cut-off time on the weekday before (by 15:59 using your app, or by the branch’s cut-off time).

You can still use cheques as you always have – but you now have more choice.

Bringing cheque processing into the 21st century

The Cheque and Credit Clearing Company, which manages cheque-clearing in the UK, introduced the Image Clearing System in 2018. Banks and building societies can now process cheques as digital images, so cheques clear faster.

Cheque imaging is now available in the Barclays app and in all of our branches.

You can still use cheques exactly as you do now, with some convenient benefits.

Get your money sooner

If you pay in cheques at a branch, they’ll now clear much faster. You’ll typically be able to withdraw your funds by 23:59 on the next weekday1 (as long as the cheque hasn’t bounced) – much quicker than the old paper-based process, which took up to six days.

More choice for paying in cheques

We’ve upgraded all of our branches for cheque imaging, so cheques paid in at a branch before its cut-off time the weekday before will clear by 23:59 the next weekday.

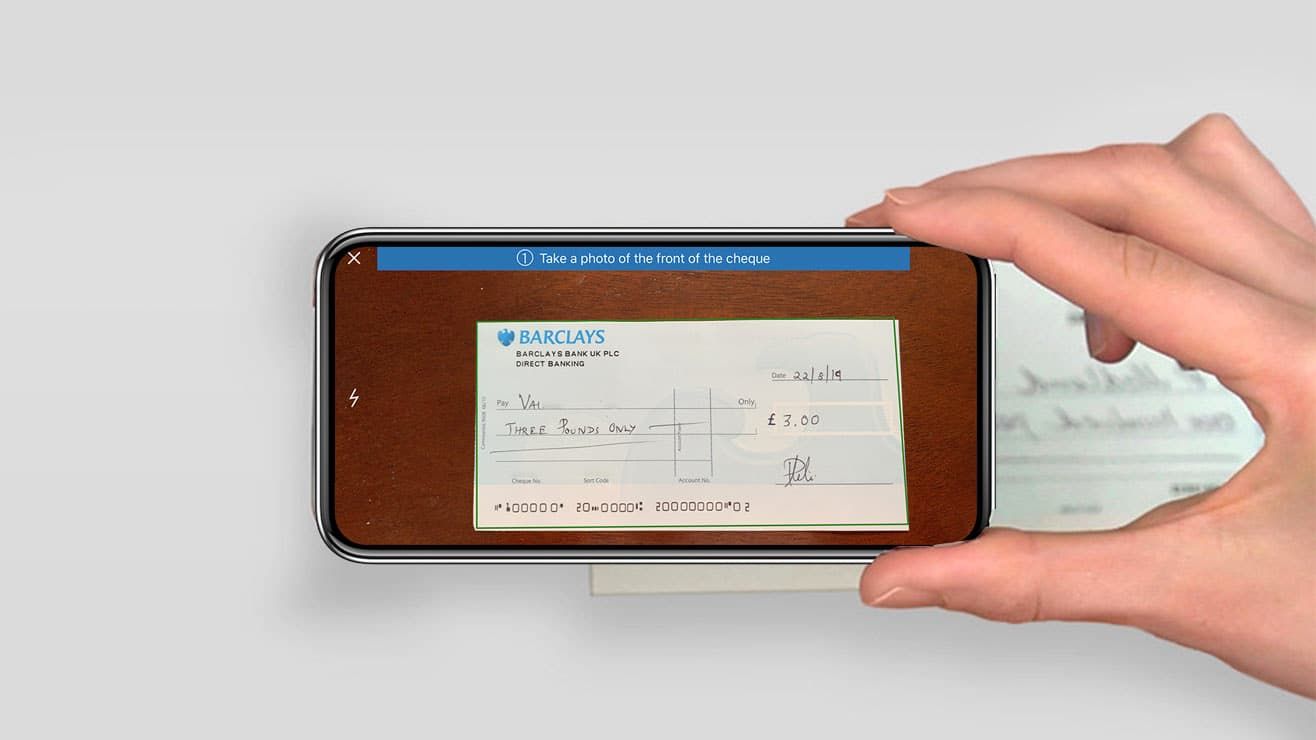

But if you don’t want to visit a branch, you can pay in a cheque without paying us a visit. We’ve pioneered a quick and easy way of paying in cheques through your Barclays app. Just take a photo of your cheque with your smartphone’s camera2 and you’ll still get your money by 23:59 on the next weekday. Read all about how it works.

Writing cheques – funds could also leave your account quicker

Don’t get caught out by faster clearing when you write a cheque. With all cheques now clearing as digital images, the money will leave your account sooner – the next weekday after the cheque is paid in. Just as now, you should only write a cheque if you have enough funds in your account to make the payment.

Stopping cheques

If you need to stop a cheque, please tell us as soon as possible. With faster clearing, if the cheque you’ve written has already been paid in, we can’t guarantee we’ll be able to stop it. Here’s more information on stopping a cheque.

Cheque clearing times

Now we’ve introduced cheque imaging, cheques will clear using the ‘next weekday’ method.

That means if you pay in a cheque at a branch before its cut-off time, or pay it in by 15:59 using your app, your cheque will clear by 23:59 the next weekday. It also means cheques you’ve written will leave your account sooner.

| Paying-in method | You pay in your cheque | Money shows in your account | You can withdraw the money | The money is yours to keep |

|---|---|---|---|---|

| At a branch | Monday 4 June Up until your branch's cut off time |

Almost instantly | From 23:59 on Tuesday 5 June (weekday 2) | By 23:59 on Tuesday 5 June (weekday 2) |

| At a branch | Monday 4 June After your branch's cut off time |

Almost instantly | From 23:59 on Wednesday 6 June (weekday 2) | By 23:59 on Wednesday 6 June (weekday 2) |

| The Barclays app3 | Monday 4 June Between 00:00 and 15:59 |

Almost instantly | From 23:59 on Tuesday 5 June (weekday 2) | By 23:59 on Tuesday 5 June (weekday 2) |

| The Barclays app3 | Monday 4 June Between 16:00 and 23:59 |

Almost instantly | From 23:59 on Wednesday 6 June (weekday 2) | By 23:59 on Wednesday 6 June (weekday 2) |

* Most branches will still be using the paper-based system until cheque imaging is fully rolled out – check with your branch.