Can I switch my rate?

To check if you’re eligible, go to the ‘Can I switch my rate' section below.

We understand the pressure you may be feeling from the rising cost of living and increased mortgage rates.

We’re here to help, and have signed up to the new Mortgage Charter recently announced by the government. We’re working with them, other mortgage lenders and regulators to offer you the support you may need.

The following will help explain what support is currently available, as well as answer some questions you may have.

To check if you’re eligible, go to the ‘Can I switch my rate' section below.

You might have seen the recent government announcement to help mortgage holders reduce their monthly payments. Here’s how we can help.

If you’re worried you might struggle with your mortgage payments, we can help. Please call us as soon as possible on 0333 202 75041 so we can find the best way to support you. We’re here Monday to Thursday from 8am to 8pm, Friday from 8am to 6pm, and Saturdays from 9am to 1pm.

Interest rates on mortgages are directly linked to the Bank of England base rate, so when this changes, mortgage rates change too. Depending on your type of mortgage (for example, whether it’s a fixed or variable rate) this might change how much you pay back each month. If your mortgage rate is fixed it won’t change until the fixed rate period ends. Read more about the base rate change.

Use our mortgage calculator tool to see how your monthly payment could be affected.

Visit our how to register help page for more information.

If you’re in the last 90 days of a mortgage rate with an early repayment charge, or it’s already ended, you can switch. If you have a tracker rate, you can switch at any time to a fixed rate with us.

You can also switch if:

If the above doesn’t apply to you, you can still switch rates, however early repayment charges may apply.

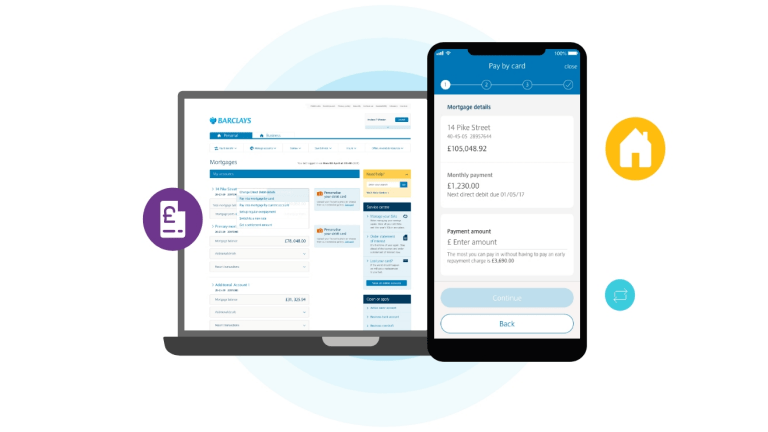

On your app home page, choose the mortgage you want to switch, then select 'Browse and switch your rate'. It’ll only take about 10 minutes to switch.

Don’t have our app? See how to register.

Just log in to Online Banking, choose the mortgage you want to switch from the list of accounts on your home page, then select 'Switch to a new rate'. It’ll only take about 10 minutes to switch.

Don’t have Online Banking? It doesn’t take long to register.

Just so you know, we’ll need to send you a passcode by post before you can switch your rate online, which can take up to five working days.

You can book an appointment if:

You can call us on 0333 202 7578. We're here Monday to Friday, from 7am to 8pm, Saturday and Sunday 7am to 5pm. Call charges.

I’ve already applied to switch my rate

If you applied to switch your rate on the phone, it can take 20 working days for your application to arrive. You’ll need to complete this to switch your rate.

If you’d like to change or cancel an application you’ve already made, you can call us on 0333 202 7580*. We’re here Monday to Friday 7am to 8pm, and Saturday to Sunday 7am to 5pm (excluding public holidays).

Visit our how to register help page for more information.

Making an overpayment

Your mortgage offer document explains how to make overpayments and how much you can overpay without paying a fee.

Find this in the Barclays app or Online Banking in ‘Statements and documents’.

See our mortgage overpayments page for more.

The base rate is the rate the Bank of England charges banks and other lenders when they borrow money. It affects the interest rates that banks charge people for their mortgage, loans, or other types of borrowing.

This means your mortgage rate could change when the Bank of England changes the base rate, depending on what type of mortgage you have.

Read more about how a change in base rate might affect your mortgage on our mortgage base rate page.

We’re here to help with your plans

Practical tips to help you understand the home-buying and mortgage process, whether you’re starting out, moving, remortgaging or buying to let.

Switch to a new rate if you have a mortgage with us

If you have a mortgage with us, we can offer you exclusive rates if you want to switch to a new deal – and you could borrow more.