Barclaycard Payments

Discover our range of payment products

Choose the payment device that’s right for your business – from our bestselling card reader to Smartpay Touch, our all-in-one point of sale solution.

The approval of your application depends on your financial circumstances and borrowing history. T&Cs apply.

- Customer service you can depend

- Industry-leading platform and network reliability

- Transparent and competitive rates – tailored to your business

- Secure – proactive fraud monitoring and dedicated data-security team

Payment solutions

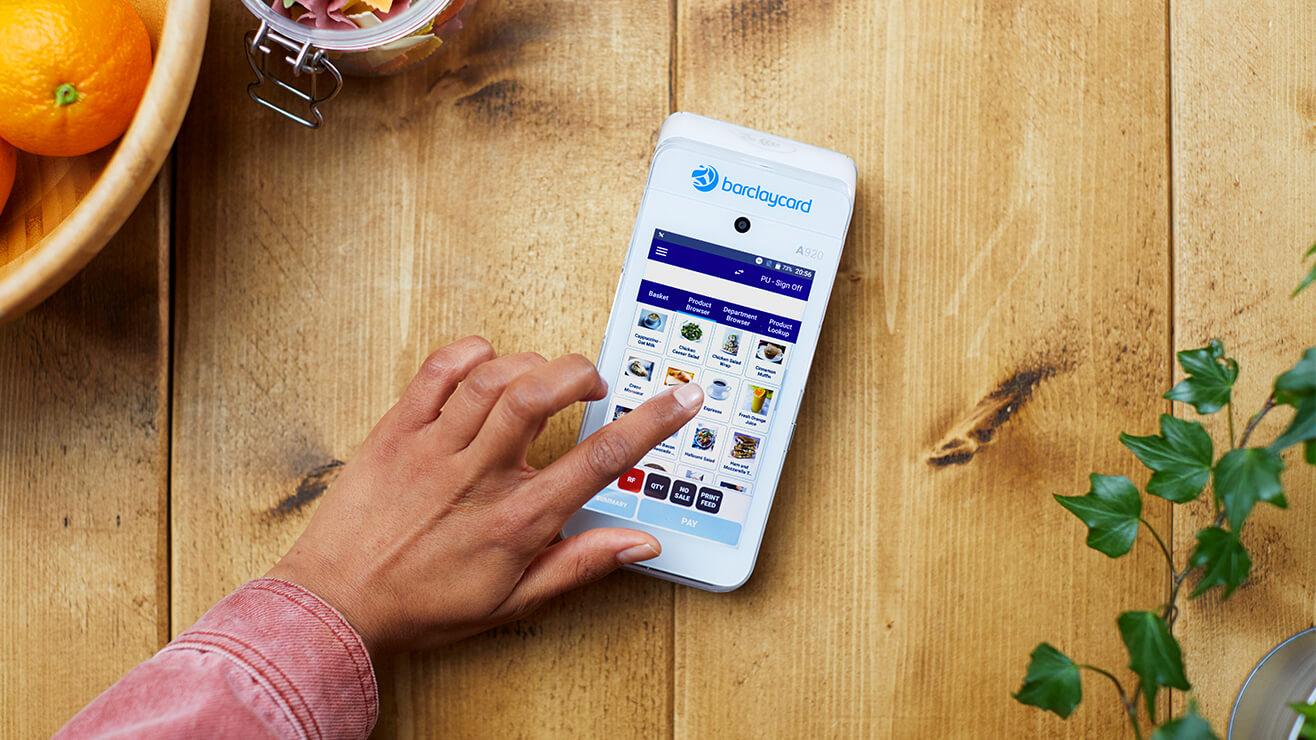

Smartpay Touch

Work smarter, not harder, with our all-in-one payment solution that lets you

- Take payments of all types, in store and on the go

- Track stock levels and streamline restocking

- Simplify back-office admin and manage bookings

- View live sales activity and see customer trends

- Enjoy free accounting software from FreshBooks Plus1

Take payments anywhere

Our pocket-sized card reader lets you do business anywhere – just connect to network data or Wi-Fi from your mobile or tablet. It’s compatible with digital wallets and packed with tools to tackle admin and make running your business easier.

Online payments

Maximise your business potential and take your sales online with a Barclaycard payment gateway, which let your customers pay easily, safely and securely.

Payments by phone or mail

Accept payments from your customers over the phone or by post with a virtual terminal.

Get in touch

Want to know more?

Please call us on 080 8296 13884– we’re here Monday to Friday from 8:30am to 6pm, except on UK bank holidays.

Already taking card payments?

Find out how much you could save by switching to us.

Are you a member of a trade association?

We partner with a number of trade associations across the UK to offer members help and support that’s specific to their industry.

If your business is a member of a trade association, please let us know by calling 0800 158 5149. Lines are open Monday to Friday, 9am to 5pm.

Other services that may interest you

Business debit cards

Manage daily expenses with a debit card

Pay for goods and services throughout the world and online, wherever Visa is accepted.

Manage cashflow with a business credit card

Get the cashflow support your business needs, whether you’re just starting out, growing or established.

This/these product(s) is/are available to clients of Barclays Bank UK PLC through referral to Barclays Bank PLC. Referred products will be owned and administered by Barclays Bank PLC. A portion of the revenue generated from referred products may be shared with Barclays UK PLC. Alternative service providers in the market may offer similar products.

Business Marketplace

Helping your business thrive

Find new partners to help your business with payment services, pensions, insurance and funding for growth.