Q3 2024 RMI update

What’s been happening in markets?

The third quarter delivered unexpected developments, from an attempted assassination of former President Trump to China’s aggressive economic actions. Despite broad expectations of a quiet quarter playing out, it ended up packed with significant events that shaped markets and outlooks.

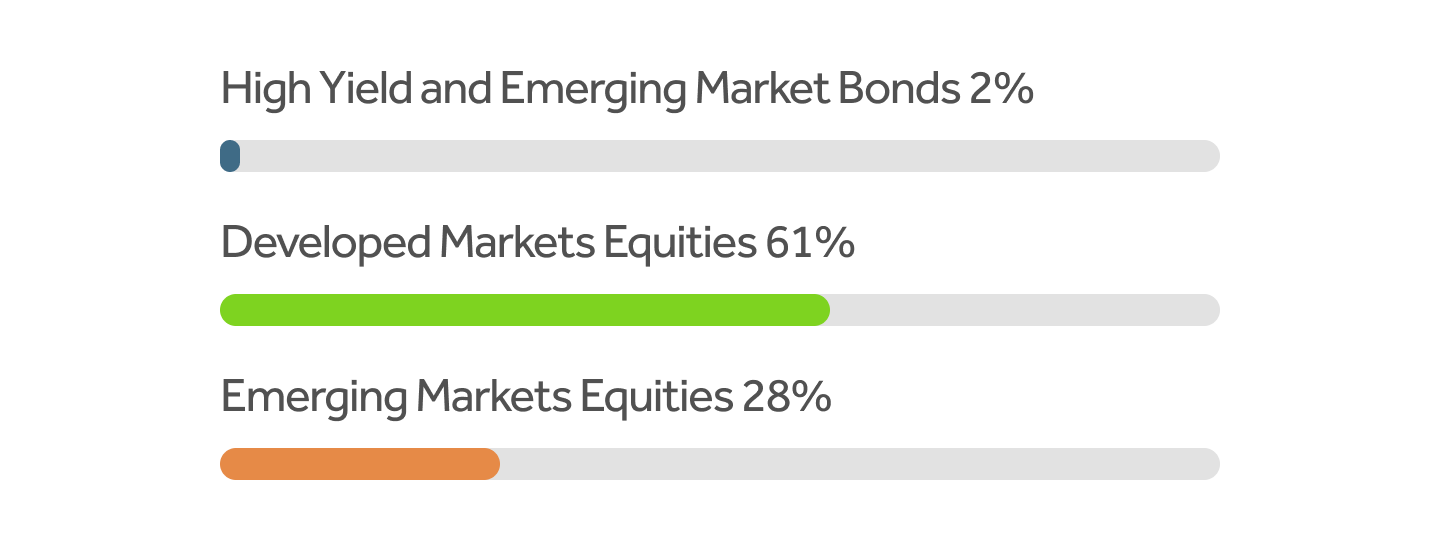

Emerging market equities, fuelled by China’s aggressive measures to combat its property crisis, finished the quarter ahead of their developed markets peers. Although China’s interventions sparked a sharp rally, uncertainty lingers about whether these measures will have lasting effects and address the issues facing China’s economy, including the ongoing property crisis and deflationary (falling prices) concerns.

The US election race remains closely contested, with both economic and political outcomes uncertain. Regardless, diversification across geographies and asset classes is the only real protection for investors against country-specific policy risk. Despite the political drama, the economy defied recession expectations, with growth exceeding forecasts and inflation easing, signalling continued resilience.

The rapid evolution of Artificial Intelligence and machine learning continues, with applications in healthcare and logistics advancing. However, much of the debate has zeroed in on the costs over the last few months. The related data centre and wider infrastructure costs are expensive to say the least. Only time will tell how, or if, this will impact long-term valuations.

Escalating conflict in the Middle East has yet to translate into significant market disruptions. Oil’s diminished role in gross domestic product (GDP) growth, as well as strategic reserves, have so far kept energy prices stable, but the risk of further escalation remains.

Germany faces significant recession risks, with weak industrial performance dragging down the broader European economy. Though Italy and Spain offer some bright spots, they are not large enough to offset Germany’s struggles.