1. Select fund

Read about our five funds, their characteristics and choose the one that matches the level of risk you’re comfortable with

A straight-forward way to invest

If you’re ready to invest but are short on time or need some inspiration, you might want to consider one of our five ready-made investment funds. You don’t need to be an expert – our team of professionals create and monitor our funds. Check if you’re ready to invest.

Read about our five funds, their characteristics and choose the one that matches the level of risk you’re comfortable with

Follow a few simple steps to open and fund your account, then you’ll be ready to buy your Ready-made Investment

Let our experts take care of the rest – they’ll ensure the fund continues to perform in line with its characteristics

Remember, the value of investments can fall as well as rise and you might not get back what you invest. On this page you’ll find information about our Ready-made Investments to help you decide if they’re right for you and tips on how to get started. Investing is not for everyone. If you’re unsure about investing, seek independent financial advice.

We like to keep investing simple. We created the following five funds to do exactly that. Each behaves in a different way, so choose one that matches your individual needs and attitude to risk.

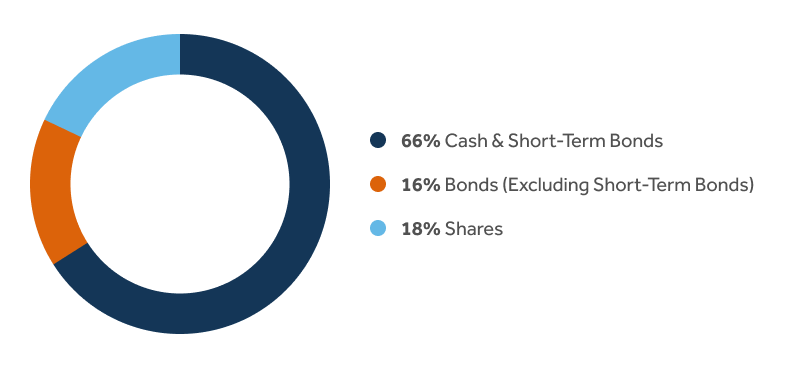

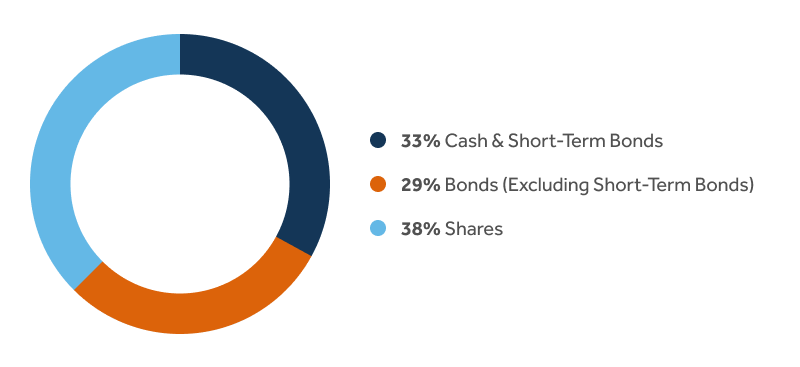

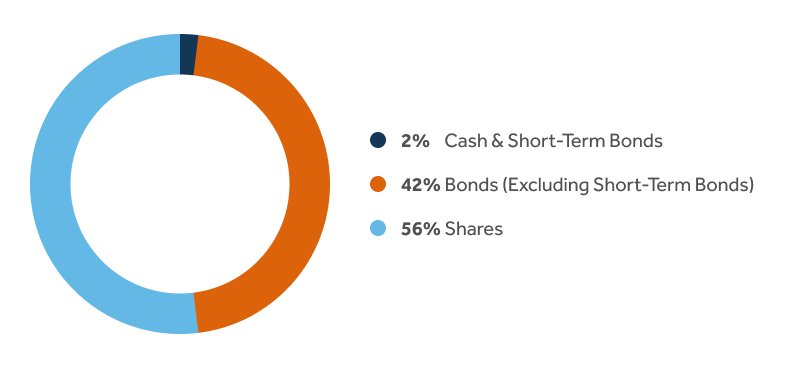

When you invest, you’re looking to boost the return on your money. It’s important to understand that alongside the chance of a bigger reward, comes the potential for bigger losses and a bumpier ride along the way – that’s “risk”. So bear this in mind when choosing your fund. In general, cash is the least risky and shares are the riskiest, with bonds sitting in between.

|

Year from 31 Oct |

2019-20 |

2020-21 |

2021-22 |

2022-23 |

2023-24 |

5-year annualised |

10-year annualised |

|---|---|---|---|---|---|---|---|

|

Global Markets 1 |

2.96% |

5.05% |

-11.54% |

3.34% |

9.71% |

1.6% |

2.1% |

Past performance isn’t a reliable indicator of future performance.

Looking for the nuts and bolts? We’ve put together these documents that you should read before you invest.

KIID [PDF, 211KB], Factsheet [PDF, 304KB], you can also read the Value Assessment here [PDF, 3.1MB]

They’ll tell you about the fund, explain how our experts have created it and its associated risks.

You can sell your fund and access your cash at any time, but remember your investment should be for the long term (at least five years) as you could get back less than you invested if you sell at any time. This is particularly likely if you sell after only a short term of investment.

Watch our short video with Barclays’ Clare Francis to learn more about the ready-made fund choices.

At Barclays, we understand that when it comes to investing, often the hardest part is knowing where to start. That’s why we offer five Ready-made Investment funds to help you take that first step. They offer a convenient one-stop solution which can be ideal if you’re not sure about making your own investment decisions, or are short on time.

These funds take the work out of investing because they’re looked after by Barclays’ investment experts who do all of the hard stuff so you don't have to. They’ll make changes to where your money’s invested depending on what’s going on in the stock markets, and keep you regularly updated with how your investment's performing. It’s worth mentioning though, that you can check how your investment's doing at any time either online or via the Barclays app.

There’s always risk involved with investing because obviously stock markets can fall as well as rise, so there’s a chance you could lose money. However, there are ways to reduce that risk and this is how the funds differ. They all invest in a mixture of shares, bonds and cash, which gives you instant diversification which is really important when it comes to investing because it can help protect against stock market falls, but the proportion they hold in each differs.

So to get started all you need to do is choose which fund to go for. Whether you’re more comfortable taking a lower risk approach or are happy to take a bit more risk in the hope of potentially higher returns, hopefully there'll be a fund to match your needs.

I hope you found that helpful – but there is a lot more information about Ready-made Investments on our website.

Here’s our latest update on how our five Ready-made Investment funds have been performing over the past three months, including what's been happening across stock markets and recent changes we've made.

How much will your Ready-made Investment cost?

There’s no charge to buy or sell these funds.

The funds all have an ongoing charge of 0.45% per year. This is taken from within the fund and reflected in the price you see when you look at your investments.

There is no additional charge if the fund outperforms it’s targets.

If you hold these funds within the Investment ISA or Investment Account the annual customer fee for the accounts will apply. The annual customer fee on those accounts is 0.25% on investments up to £200,000 and 0.05% on investments above £200,000.

You can choose from two types of account. Once your account is open, you can buy your chosen Ready-made Investment.

The most popular account people chose when they start to invest.

You can pay in up to £20,000 per tax year

Any returns you make are tax-free.

Tax rules can change in future and their effects on you will depend on your individual circumstances.

A flexible account which you might want to consider if you’ve already used your ISA allowance for the current tax year OR you’re already paying into an ISA with another provider.

No limits on the amount you can invest.

The return you make on your investments will be taxable but there are allowances that may mean you don’t pay tax, or it is reduced.

Smart Investor is an investment service for UK residents aged 18 or over. The service is not available to US persons, even if they are resident in the UK.

You can buy this Ready-made Investment using an existing account.

|

Year from 31 Oct |

2019-20 |

2020-21 |

2021-22 |

2022-23 |

2023-24 |

5-year annualised |

10-year annualised |

|---|---|---|---|---|---|---|---|

|

Global Markets 2 |

3.42% |

9.39% |

-11.24% |

2.99% |

13.78% |

3.3% |

3.8% |

Past performance isn’t a reliable indicator of future performance.

Looking for the nuts and bolts? We’ve put together these documents that you should read before you invest.

KIID [PDF, 211KB], Factsheet [PDF, 304KB], you can also read the Value Assessment here [PDF, 3.1MB]

They’ll tell you about the fund, explain how our experts have created it and its associated risks.

You can sell your fund and access your cash at any time, but remember your investment should be for the long term (at least five years) as you could get back less than you invested if you sell at any time. This is particularly likely if you sell after only a short term of investment.

Watch our short video with Barclays’ Clare Francis to learn more about the ready-made fund choices.

At Barclays, we understand that when it comes to investing, often the hardest part is knowing where to start. That’s why we offer five Ready-made Investment funds to help you take that first step. They offer a convenient one-stop solution which can be ideal if you’re not sure about making your own investment decisions, or are short on time.

These funds take the work out of investing because they’re looked after by Barclays’ investment experts who do all of the hard stuff so you don't have to. They’ll make changes to where your money’s invested depending on what’s going on in the stock markets, and keep you regularly updated with how your investment's performing. It’s worth mentioning though, that you can check how your investment's doing at any time either online or via the Barclays app.

There’s always risk involved with investing because obviously stock markets can fall as well as rise, so there’s a chance you could lose money. However, there are ways to reduce that risk and this is how the funds differ. They all invest in a mixture of shares, bonds and cash, which gives you instant diversification which is really important when it comes to investing because it can help protect against stock market falls, but the proportion they hold in each differs.

So to get started all you need to do is choose which fund to go for. Whether you’re more comfortable taking a lower risk approach or are happy to take a bit more risk in the hope of potentially higher returns, hopefully there'll be a fund to match your needs.

I hope you found that helpful – but there is a lot more information about Ready-made Investments on our website.

Here’s our latest update on how our five Ready-made Investment funds have been performing over the past three months, including what's been happening across stock markets and recent changes we've made.

How much will your Ready-made Investment cost?

There’s no charge to buy or sell these funds.

The funds all have an ongoing charge of 0.45% per year. This is taken from within the fund and reflected in the price you see when you look at your investments.

There is no additional charge if the fund outperforms it’s targets.

If you hold these funds within the Investment ISA or Investment Account the annual customer fee for the accounts will apply. The annual customer fee on those accounts is 0.25% on investments up to £200,000 and 0.05% on investments above £200,000.

You can choose from two types of account. Once your account is open, you can buy your chosen Ready-made Investment.

The most popular account people chose when they start to invest.

You can pay in up to £20,000 per tax year

Any returns you make are tax-free.

Tax rules can change in future and their effects on you will depend on your individual circumstances.

A flexible account which you might want to consider if you’ve already used your ISA allowance for the current tax year OR you’re already paying into an ISA with another provider.

No limits on the amount you can invest.

The return you make on your investments will be taxable but there are allowances that may mean you don’t pay tax, or it is reduced.

Smart Investor is an investment service for UK residents aged 18 or over. The service is not available to US persons, even if they are resident in the UK.

You can buy this Ready-made Investment using an existing account.

|

Year from 31 Oct |

2019-20 |

2020-21 |

2021-22 |

2022-23 |

2023-24 |

5-year annualised |

10-year annualised |

|---|---|---|---|---|---|---|---|

|

Global Markets 3 |

3.80% |

14.58% |

-9.74% |

4.47% |

17.10% |

5.6% |

5.7% |

Past performance isn’t a reliable indicator of future performance.

Looking for the nuts and bolts? We’ve put together these documents that you should read before you invest

KIID [PDF, 211KB], Factsheet [PDF, 304KB], you can also read the Value Assessment here [PDF, 3.1MB]

They’ll tell you about the fund, explain how our experts have created it and its associated risks.

You can sell your fund and access your cash at any time, but remember your investment should be for the long term (at least five years) as you could get back less than you invested if you sell at any time. This is particularly likely if you sell after only a short term of investment.

Watch our short video with Barclays’ Clare Francis to learn more about the ready-made fund choices.

At Barclays, we understand that when it comes to investing, often the hardest part is knowing where to start. That’s why we offer five Ready-made Investment funds to help you take that first step. They offer a convenient one-stop solution which can be ideal if you’re not sure about making your own investment decisions, or are short on time.

These funds take the work out of investing because they’re looked after by Barclays’ investment experts who do all of the hard stuff so you don't have to. They’ll make changes to where your money’s invested depending on what’s going on in the stock markets, and keep you regularly updated with how your investment's performing. It’s worth mentioning though, that you can check how your investment's doing at any time either online or via the Barclays app.

There’s always risk involved with investing because obviously stock markets can fall as well as rise, so there’s a chance you could lose money. However, there are ways to reduce that risk and this is how the funds differ. They all invest in a mixture of shares, bonds and cash, which gives you instant diversification which is really important when it comes to investing because it can help protect against stock market falls, but the proportion they hold in each differs.

So to get started all you need to do is choose which fund to go for. Whether you’re more comfortable taking a lower risk approach or are happy to take a bit more risk in the hope of potentially higher returns, hopefully there'll be a fund to match your needs.

I hope you found that helpful – but there is a lot more information about Ready-made Investments on our website.

Here’s our latest update on how our five Ready-made Investment funds have been performing over the past three months, including what's been happening across stock markets and recent changes we've made.

How much will your Ready-made Investment cost?

There’s no charge to buy or sell these funds.

The funds all have an ongoing charge of 0.45% per year. This is taken from within the fund and reflected in the price you see when you look at your investments.

There is no additional charge if the fund outperforms it’s targets.

If you hold these funds within the Investment ISA or Investment Account the annual customer fee for the accounts will apply. The annual customer fee on those accounts is 0.25% on investments up to £200,000 and 0.05% on investments above £200,000.

You can choose from two types of account. Once your account is open, you can buy your chosen Ready-made Investment.

The most popular account people chose when they start to invest.

You can pay in up to £20,000 per tax year

Any returns you make are tax-free.

Tax rules can change in future and their effects on you will depend on your individual circumstances.

A flexible account which you might want to consider if you’ve already used your ISA allowance for the current tax year OR you’re already paying into an ISA with another provider.

No limits on the amount you can invest.

The return you make on your investments will be taxable but there are allowances that may mean you don’t pay tax, or it is reduced.

Smart Investor is an investment service for UK residents aged 18 or over. The service is not available to US persons, even if they are resident in the UK.

You can buy this Ready-made Investment using an existing account.

|

Year from 31 Oct |

2019-20 |

2020-21 |

2021-22 |

2022-23 |

2023-24 |

5-year annualised |

10-year annualised |

|---|---|---|---|---|---|---|---|

|

Global Markets 4 |

3.76% |

19.78% |

-8.23% |

5.36% |

19.43% |

7.5% |

7.1% |

Past performance isn’t a reliable indicator of future performance.

Looking for the nuts and bolts? We’ve put together these documents that you should read before you invest.

KIID [PDF, 211KB], Factsheet [PDF, 304KB], you can also read the Value Assessment here [PDF, 3.1MB]

They’ll tell you about the fund, explain how our experts have created it and its associated risks.

You can sell your fund and access your cash at any time, but remember your investment should be for the long term (at least five years) as you could get back less than you invested if you sell at any time. This is particularly likely if you sell after only a short term of investment.

Watch our short video with Barclays’ Clare Francis to learn more about the ready-made fund choices.

At Barclays, we understand that when it comes to investing, often the hardest part is knowing where to start. That’s why we offer five Ready-made Investment funds to help you take that first step. They offer a convenient one-stop solution which can be ideal if you’re not sure about making your own investment decisions, or are short on time.

These funds take the work out of investing because they’re looked after by Barclays’ investment experts who do all of the hard stuff so you don't have to. They’ll make changes to where your money’s invested depending on what’s going on in the stock markets, and keep you regularly updated with how your investment's performing. It’s worth mentioning though, that you can check how your investment's doing at any time either online or via the Barclays app.

There’s always risk involved with investing because obviously stock markets can fall as well as rise, so there’s a chance you could lose money. However, there are ways to reduce that risk and this is how the funds differ. They all invest in a mixture of shares, bonds and cash, which gives you instant diversification which is really important when it comes to investing because it can help protect against stock market falls, but the proportion they hold in each differs.

So to get started all you need to do is choose which fund to go for. Whether you’re more comfortable taking a lower risk approach or are happy to take a bit more risk in the hope of potentially higher returns, hopefully there'll be a fund to match your needs.

I hope you found that helpful – but there is a lot more information about Ready-made Investments on our website.

Here’s our latest update on how our five Ready-made Investment funds have been performing over the past three months, including what's been happening across stock markets and recent changes we've made.

How much will your Ready-made Investment cost?

There’s no charge to buy or sell these funds.

The funds all have an ongoing charge of 0.45% per year. This is taken from within the fund and reflected in the price you see when you look at your investments.

There is no additional charge if the fund outperforms it’s targets.

If you hold these funds within the Investment ISA or Investment Account the annual customer fee for the accounts will apply. The annual customer fee on those accounts is 0.25% on investments up to £200,000 and 0.05% on investments above £200,000.

You can choose from two types of account. Once your account is open, you can buy your chosen Ready-made Investment.

The most popular account people chose when they start to invest.

You can pay in up to £20,000 per tax year

Any returns you make are tax-free.

Tax rules can change in future and their effects on you will depend on your individual circumstances.

A flexible account which you might want to consider if you’ve already used your ISA allowance for the current tax year OR you’re already paying into an ISA with another provider.

No limits on the amount you can invest.

The return you make on your investments will be taxable but there are allowances that may mean you don’t pay tax, or it is reduced.

Smart Investor is an investment service for UK residents aged 18 or over. The service is not available to US persons, even if they are resident in the UK.

You can buy this Ready-made Investment using an existing account.

|

Year from 31 Oct |

2019-20 |

2020-21 |

2021-22 |

2022-23 |

2023-24 |

5-year annualised |

10-year annualised |

|---|---|---|---|---|---|---|---|

|

Global Markets 5 |

3.89% |

23.52% |

-7.06% |

5.71% |

21.30% |

8.9% |

8.1% |

Past performance isn’t a reliable indicator of future performance.

Looking for the nuts and bolts? We’ve put together these documents that you should read before you invest.

KIID [PDF, 211KB], Factsheet [PDF, 304KB], you can also read the Value Assessment here [PDF, 3.1MB]

They’ll tell you about the fund, explain how our experts have created it and its associated risks.

You can sell your fund and access your cash at any time, but remember your investment should be for the long term (at least five years) as you could get back less than you invested if you sell at any time. This is particularly likely if you sell after only a short term of investment.

Watch our short video with Barclays’ Clare Francis to learn more about the ready-made fund choices.

At Barclays, we understand that when it comes to investing, often the hardest part is knowing where to start. That’s why we offer five Ready-made Investment funds to help you take that first step. They offer a convenient one-stop solution which can be ideal if you’re not sure about making your own investment decisions, or are short on time.

These funds take the work out of investing because they’re looked after by Barclays’ investment experts who do all of the hard stuff so you don't have to. They’ll make changes to where your money’s invested depending on what’s going on in the stock markets, and keep you regularly updated with how your investment's performing. It’s worth mentioning though, that you can check how your investment's doing at any time either online or via the Barclays app.

There’s always risk involved with investing because obviously stock markets can fall as well as rise, so there’s a chance you could lose money. However, there are ways to reduce that risk and this is how the funds differ. They all invest in a mixture of shares, bonds and cash, which gives you instant diversification which is really important when it comes to investing because it can help protect against stock market falls, but the proportion they hold in each differs.

So to get started all you need to do is choose which fund to go for. Whether you’re more comfortable taking a lower risk approach or are happy to take a bit more risk in the hope of potentially higher returns, hopefully there'll be a fund to match your needs.

I hope you found that helpful – but there is a lot more information about Ready-made Investments on our website.

Here’s our latest update on how our five Ready-made Investment funds have been performing over the past three months, including what's been happening across stock markets and recent changes we've made.

How much will your Ready-made Investment cost?

There’s no charge to buy or sell these funds.

The funds all have an ongoing charge of 0.45% per year. This is taken from within the fund and reflected in the price you see when you look at your investments.

There is no additional charge if the fund outperforms it’s targets.

If you hold these funds within the Investment ISA or Investment Account the annual customer fee for the accounts will apply. The annual customer fee on those accounts is 0.25% on investments up to £200,000 and 0.05% on investments above £200,000.

You can choose from two types of account. Once your account is open, you can buy your chosen Ready-made Investment.

The most popular account people chose when they start to invest.

You can pay in up to £20,000 per tax year

Any returns you make are tax-free.

Tax rules can change in future and their effects on you will depend on your individual circumstances.

A flexible account which you might want to consider if you’ve already used your ISA allowance for the current tax year OR you’re already paying into an ISA with another provider.

No limits on the amount you can invest.

The return you make on your investments will be taxable but there are allowances that may mean you don’t pay tax, or it is reduced.

Smart Investor is an investment service for UK residents aged 18 or over. The service is not available to US persons, even if they are resident in the UK.

You can buy this Ready-made Investment using an existing account.

|

Fund |

Cash and short-term bonds |

Bonds (Excluding Short-Term Bonds) |

Shares |

|---|---|---|---|

|

Global Markets Defensive Fund |

66% |

16% |

18% |

|

Global Markets Cautious Fund |

33% |

29% |

38% |

|

Global Markets Balanced Fund |

2% |

42% |

56% |

|

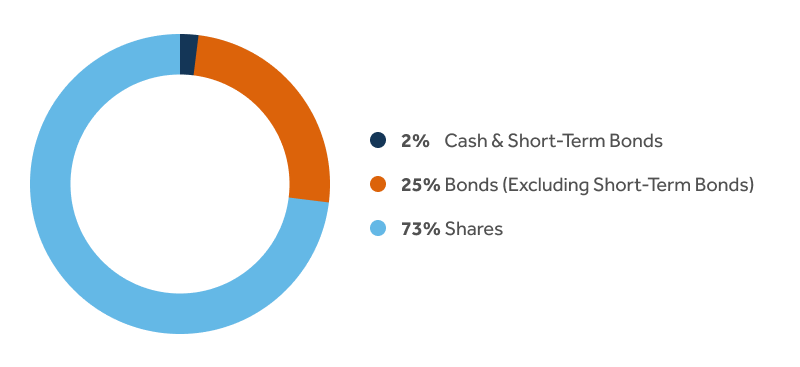

Global Markets Growth Fund |

2% |

25% |

73% |

|

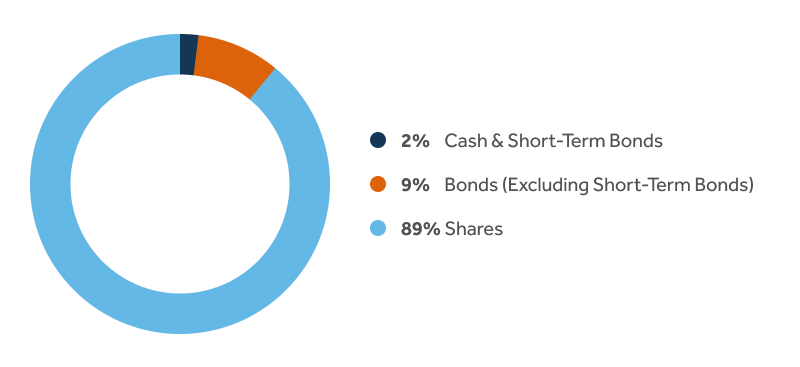

Global Markets Adventurous Fund |

2% |

9% |

89% |

Please note: The actual asset allocation may deviate from those weights shown due to intentional shifts we make to take advantage of short-term opportunities and risks, as we see them.

If you already have an account, log in to continue.

If you have any questions, you can give us a call on 0800 279 36672.