How do I download Midata transactions to compare current accounts?

What is Midata?

Midata is a government scheme to let people safely access and use their personal data.

You can use the personal current account comparison service to download up to 12 months' transaction data from your account to use with online personalised price-comparison services.

The download will show the amount of each transaction and the date it was applied. Also included will be a transaction code and short description to help comparison providers understand the type of transaction. If you have an overdraft limit, you'll be able to see what it was at the time of the download.

How do I download my Midata transactions?

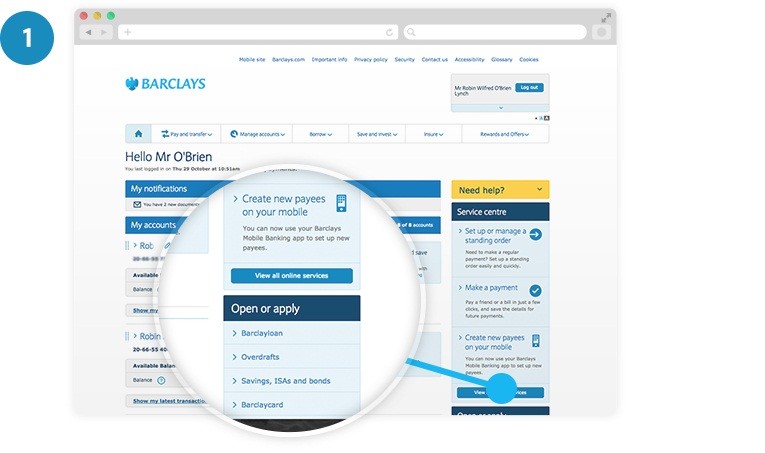

- Log in to Online Banking

- Select ‘View all online services’ from the ‘Service centre’ panel

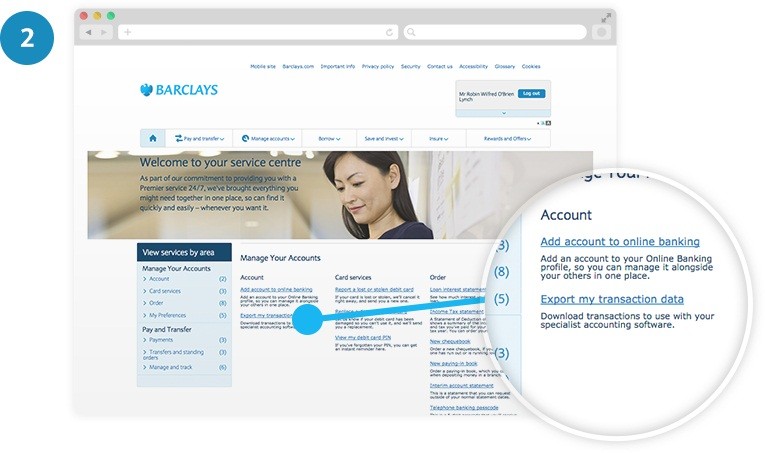

- Choose ‘Export my transaction data’

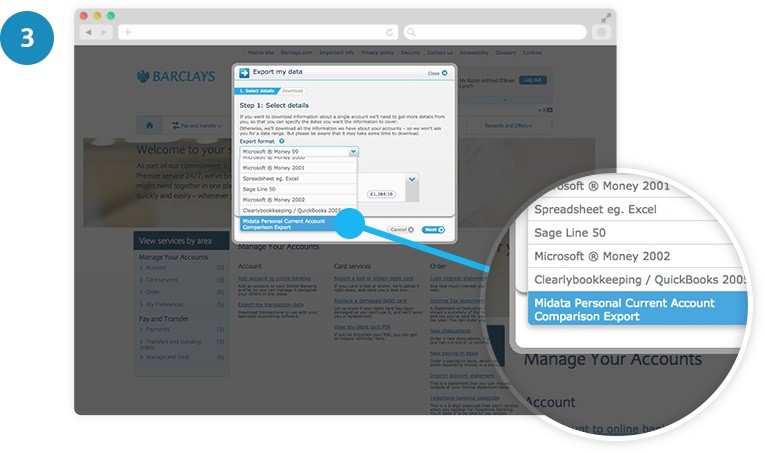

- From the dropdown menu, select ‘Midata Personal Current Account Comparison Export’ and follow the onscreen instructions

Once you've downloaded the file, you can upload it to comparison providers' websites.

Please note, this function isn’t available within the Barclays app.

Is it safe?

Your transaction data can give a detailed picture of your financial choices and lifestyle. This information is valuable and could potentially put you at risk if it got into the wrong hands. Therefore, we mask some of the descriptions in the download to reduce the amount of personal information included. This is to protect you and others whose details may appear.

To protect yourself further when using the Midata service, you should:

- Never upload the file to a website unless you're comfortable with the site and how it intends to use your details. We suggest you check its privacy policy to see if it will use your personal information for anything other than comparing accounts

- Never share your Online Banking credentials with anyone else. The Midata account comparison works by you getting your file from us and choosing to pass it to a website that offers a comparison service

- Make sure you keep the file secure. Read advice on how to protect your computer

If you're requesting data for a joint account, please make sure the other account holders are happy for you to download and share their information in this way.

For more information, see the Midata personal current account comparisons code of practice.

You may also wish to check if a comparison site you want to use has committed to this code.

Things you need to know

The download won't include any transactions you've made in the past month. And if you opened your account within the previous 13 months, your download will start from the opening date, so may not include a full 12 months' data.

For joint accounts, either party to the account will be able to download the data. Permission must be gained from the other party. Customers who become a party to an existing account are only able to access data for the period they have been party to the account.

Online comparison providers that allow you to upload your Midata file will compare your transaction profile with current accounts from other providers. They'll show you the costs and benefits of doing those transactions with a number of providers - including us.

However, the results are based primarily on the transaction data, and may not account for any enhanced service, added-value benefits, reward propositions or relationship-management services you get with your account. The comparison providers should let you know if there are any such limitations to their results.

Please note that while the results may include the cost and benefits of conducting your transactions with us, this may not be the same as the cost and benefits of the account you currently have (eg, if you have a Barclays current account that's no longer available on the same terms). The comparison provider's assessment is also based on your historic account usage, so may not necessarily reflect how you'll use your account in future.

Thinking of leaving Barclays?

If the results make you think you might get a better deal elsewhere, please contact us so we can see if there's anything we can do to change your mind. If we can't, then we'd really benefit from your feedback on how to improve our services.