What is a consolidated tax certificate, and how do I request one for my Smart Investor investments?

The consolidated tax certificate (CTC) is a summary of the returns you've received on your investment portfolio and shows any tax that has been deducted at source from the dividends you’ve received.

You can use the information in the CTC to help you complete your Self Assessment tax return.

CTCs are usually issued at the end of each tax year, unless you have asked to receive your CTC at a different time in the year. They are issued for Investment Accounts and SIPPs, but not for Investment ISAs because any returns you receive within an ISA are tax-free.

You can access your CTC through My Barclays documents after logging in. You'll be able to print a copy of your certificate, as well as your statements and valuations.

You can select how to receive your CTC documents from us by updating your communication preferences online by following these steps:

- Log in to your Smart Investor account, and click on the 'Investments’ tab

- Select 'Manage account’ from the dropdown menu at the top of the screen

- Under ‘Investment settings’ select ‘Important documents’ on the following screen and follow the onscreen instructions.

What your CTC shows

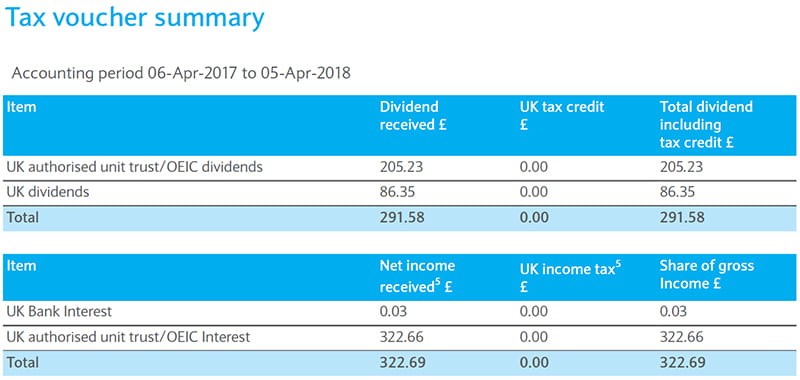

You’ll see a table similar to the one below on your CTC showing a summary of the tax credits and dividends you received.

The rest of your CTC will show a breakdown of the UK dividend and distribution schedule, as well as the interest you earned within your Investment Account and on any UK Authorised Unit Trusts and OEICs from the previous tax year.

You should always make sure you read the notes section at the end of your CTC to make sure you fully understand the information it provides, before returning your Self Assessment tax return.

Tax certificate

We’ll only issue a Tax certificate (R189K) for distributions received after 11 December 2014. If you’d like to request one, please call us on 0800 279 3667.1